The pizza giant’s founder and CEO, John Schnatter, notified the Securities and Exchange Commission that he’d adopted a stock trading plan today under which he may sell up to 480,000 company shares, a block worth $36.4 million at today’s closing price of $75.75.

In a late-afternoon filing with the SEC disclosing the plan, Schnatter didn’t provide any more details, such as a timetable for when he would sell and in what amounts.

Company executives often adopt these “10b5-1” plans, named for the SEC rule that governs insider trading. The plans are often approved by a company’s board of directors, and require an executive to sell a certain number of shares at fixed intervals to avoid any appearance they’re trading on inside information.

Today’s filing came after stock markets closed. In extended trading, PZZA shares hardly fluttered, indicating Wall Street wasn’t concerned. That’s not surprising. Even if Schnatter had sold all 480,000 shares today, he’d still own about 10 million, including those subject to options — a stake equal to 26.3% of all outstanding shares. He would still be the company’s single-biggest stockholder, with a total stake worth $758 million.

The filing was noteworthy for another reason. Without explaining why, Papa John’s said it would not disclose any future 10b5-1 plans that might be adopted by other officers or directors. Nor will it report any changes or termination of any publicly announced trading plan, including Schnatter’s, except to the extent required by law.

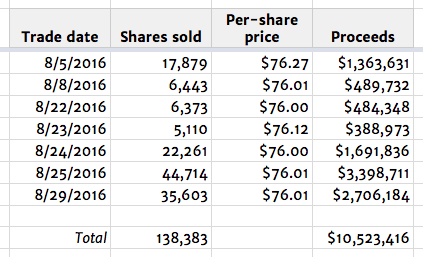

Schnatter’s plan follows an especially busy month of trading for the executive. Since Aug. 5, he’s sold more than 138,000 shares for $10.5 million; chart, below.