Just because the Community Foundation of Louisville bears the city’s name doesn’t mean all its biggest grants go to local charities.

The foundation’s newest IRS tax return shows it gave $6.3 million to the Schwab Charitable Fund in San Francisco during the year ended June 3o, 2015 — its single-biggest gift during the period, and one far larger than its top gifts in the previous two years.

The Schwab Fund — which is affiliated with the discount brokerage of the same name — is an enormous donor-advised charity that gives money to other non-profits across the country at the direction of its individual donors. Indeed, some of those nonprofits are back here in Louisville.

The Schwab Fund — which is affiliated with the discount brokerage of the same name — is an enormous donor-advised charity that gives money to other non-profits across the country at the direction of its individual donors. Indeed, some of those nonprofits are back here in Louisville.

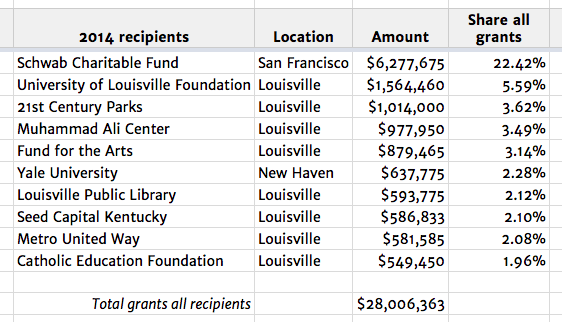

The Schwab grant accounted for more than 22% of the total $28 million in grants made by the Community Foundation during the year. Here were the top 10:

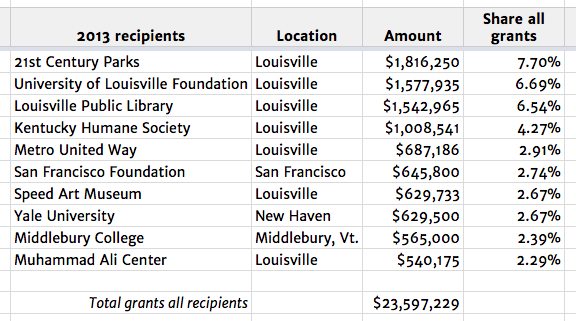

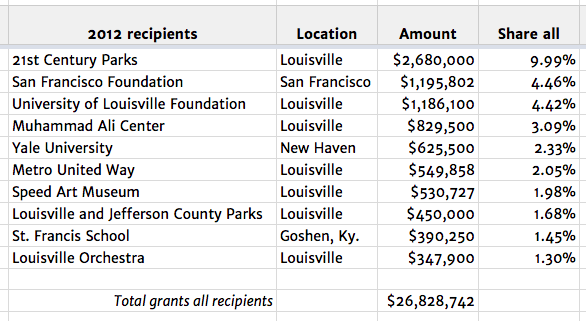

In its 2013 and 2012 years, the Community Foundation also made large contributions to San Francisco charities — in both cases, the San Francisco Foundation — but nowhere near as large as the one to Schwab.

In both those years, the Community Foundation’s single-biggest grants went to 21st Century Parks, the non-profit that developed and maintains the sprawling Parklands of Floyds Fork, a group of four parks on 3,700 acres in eastern Jefferson County. Here were the top 10 those years:

Although the Louisville Community Foundation supports many local charities, it doesn’t limit its grants to the city. In fiscal 2014, only about $600,000 of the $28 million in grants came from the foundation’s unrestricted funds. The rest was made according to the terms of about 230 individual donor-advised funds it manages.

In its tax returns, the foundation doesn’t identify how much each of those donor-advised funds contribute, so there’s no way to know why so much money went to the Schwab Charitable Fund.

The Schwab Fund’s own tax return doesn’t offer a definitive answer, either. In its 2014 year, the fund made $1.1 billion in grants to more than 17,000 different non-profits — including nearly 30 back here in Louisville; indeed, one of those was 21st Century Parks, which got $105,000.

Photo, top: The Golden Gate Bridge, with the San Francisco skyline in the distance.