A news summary focused on 10 big employers; updated 8:41 a.m.

YUM has agreed to an advance sale of a $464 million slice of its China operations to a prominent Chinese deal maker and the financial affiliate of Chinese Internet giant Alibaba. The deal announced this morning is with Primavera Capital and Ant Financial Services Group. They will buy the shares at an 8% discount to the average price at which Yum China’s shares trade between 31 and 60 days after they’re distributed to Yum shareholders in a spinoff expected by Oct. 31. Yum China will start trading on the New York Stock Exchange as an independent company on Nov. 1 under the ticker symbol “YUMC.”

Louisville-based Yum also announced Primavera founder Dr. Fred Hu, former chairman of Greater China at Goldman Sachs, will become Yum China’s non-executive board chairman. In a statement, Yum CEO Greg Creed said: “The investments from Primavera and Ant Financial in Yum China mark another important milestone in our plans to separate the China business and create a solid foundation for Yum China” (Wall Street Journal and press release).

GE APPLIANCES owner Haier is filling a hole in its product lineup: It will begin to sell Haier-branded gas cooktops, induction cooktops and ovens in the U.K., beginning next year. China-based Haier hasn’t yet released prices or dates when they might appear in other countries, however. Haier bought Louisville-based GE Appliances for $5.6 billion in June, in a bid to gain a stronger presence in the U.S., where it has only 1.1% of the appliance market. The Louisville company employs 6,000 workers at Appliance Park in the south end (CNET).

KFC: YouTube vlogger Hellthy Junk Food has done a blind taste taste of real KFC fried chicken vs. that purportedly leaked super-secret recipe of 11 herbs and spaces founder Harlan Sanders created. Posted Tuesday, the video’d results have already drawn 75,000 views — and they don’t bode well for the chain:

BROWN-FORMAN: Financial news site Seeking Alpha Continue reading “Yum agrees to sell $464M stake in China unit ahead of spinoff; Haier to brand cooktops and ovens in U.K.; plus more (possibly) bad news about the (allegedly) leaked KFC recipe”

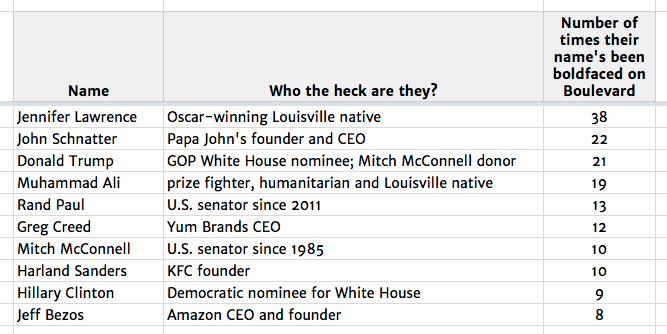

Boulevard reviews the latest media coverage of

Boulevard reviews the latest media coverage of

This leads me to another footnote, of sorts — one that appeared on a story today at

This leads me to another footnote, of sorts — one that appeared on a story today at

The risk in this strategy is that The Courier-Journal’s owner, Gannett Co., walks away instead of acquiring Tronc, leaving its rival newspaper publisher to wither like Yahoo or find its own path to success, Solomon says. And if you accept Gannett’s argument,

The risk in this strategy is that The Courier-Journal’s owner, Gannett Co., walks away instead of acquiring Tronc, leaving its rival newspaper publisher to wither like Yahoo or find its own path to success, Solomon says. And if you accept Gannett’s argument,