Neil Budde‘s abrupt resignation was announced this morning in an email to staff from Publisher Wesley Jackson, who didn’t provide an explanation for his departure. Budde, who is about 60, had been in the job since September 2013.

Budde leaves as the paper faces heightened competition from legacy rivals such as WDRB and from new ones: WFPL’s Kentucky Center for Investigative Reporting, and digital standalone Insider Louisville.

In his email, Jackson said: “We will sharpen our focus on investigative journalism and the urgency of all our coverage while doubling down on our goals of building new audiences and engaging them digitally.”

Jackson didn’t say whether any other staffing changes were in the works.

CJ owner Gannett Co. is ramping up efforts to coordinate news coverage among the approximately 100 dailies in the chain by having reporters from different sites work together on projects with a more national scope. The Louisville paper’s shakeup also comes as Gannett draws closer to buying Tronc, which owns the Los Angeles Times, Chicago Tribune and seven other big dailies plus 160 smaller weekly and monthly niche titles.

Jeff Taylor, the top editor at the CJ’s sister paper, the Indianapolis Star, will serve as interim editor while a permanent editor is found, according to Jackson.

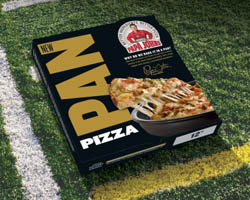

Papa John’s is promoting the new menu item with a specially designed black box, and a new advertising campaign featuring retired Denver Broncos quarterback Peyton Manning, NFL Defensive Player of the Year J.J. Watt, and CEO John Schnatter. (See, above.)

Papa John’s is promoting the new menu item with a specially designed black box, and a new advertising campaign featuring retired Denver Broncos quarterback Peyton Manning, NFL Defensive Player of the Year J.J. Watt, and CEO John Schnatter. (See, above.)