. . . until the 143rd Kentucky Derby, of course! That’s according to our exclusive 2017 Derby Countdown Clock™. Until then, let’s swoon over singer Ray J. and fashion designer Princess Love from their appearance at this year’s first Saturday in May.

Embed from Getty Images

Tag: The A-list

Boulevard reviews the latest media coverage of the Oscar-winning Louisville native in our exclusive Jennifer Lawrence Diary™. Today’s news, rated on a scale of 1-5 stars:

Boulevard reviews the latest media coverage of the Oscar-winning Louisville native in our exclusive Jennifer Lawrence Diary™. Today’s news, rated on a scale of 1-5 stars:

![]() Legendary Pictures emerged victorious last night, landing the pitch package “Bad Blood,” with Lawrence starring as Elizabeth Holmes, the disgraced founder of controversial Silicon Valley blood-test company Theranos, according to Deadline.

Legendary Pictures emerged victorious last night, landing the pitch package “Bad Blood,” with Lawrence starring as Elizabeth Holmes, the disgraced founder of controversial Silicon Valley blood-test company Theranos, according to Deadline.

Legendary will pay around $3.5 million for the script to be written by director Adam McKay, who just shared a Best Adapted Screenplay Oscar for “The Big Short.” McKay will direct as well. Universal will distribute through its deal with Legendary, according to Deadline.

The trade site had reported earlier that the project featured all the requisites for the big packages studios are responding to right now, including a hot-button subject matter and Oscar winner Lawrence, 25, who’s found herself in the Academy Awards mix on prestige projects, most recently another film about an entrepreneur ‘Joy.’”

The mania around the latest movie cements Lawrence’s status as one of Hollywood’s most bankable stars — and highest paid, too: a reported $20 million per film.

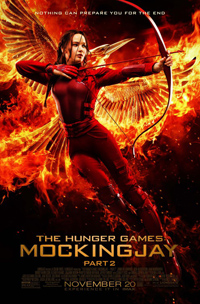

The “Hunger Games” series star pulled in $52 million between June 2014 and June 2015 alone, ranking her No. 34 of 95 on Forbes’ magazine’s latest list of the world’s highest-paid celebrities. No. 1: professional boxer Floyd Mayweather, at $300 million.

“Bad Blood” is Lawrence’s fourth project in the works. She’s now filming an untitled Darren Aronofsky project; “Passengers” is in post-production with a Dec. 21 release date, and “It’s What I Do” is in pre-production. There’s also been speculation she might star opposite Sandra Bullock in an all-female reboot of “Ocean’s Eleven.”

10:40 a.m., the Muhammad Ali Center. CEO Donald Lassere is visible on a TV cameraman’s video monitor as he tells a press conference the UPS Foundation has donated $500,000 to the museum honoring the Louisville native.

The gift will fund the center’s education initiatives, including UCrew, Generation Ali, its Character Education Program “Creating Our Future,” and the Muhammad Ali Center Council of Students. More about the Ali Center.

The UPS Foundation is the charitable arm of the shipping giant, which has 22,000 workers in Louisville — the city’s single-biggest employer. More about UPS and about its foundation.

Mayor Greg Fischer was there, too. But one of the most important people present — maybe the most important — wasn’t publicly acknowledged at all: Brown-Forman heiress Ina Brown Bond, one of the Ali Center’s main movers.

Boulevard reviews the latest media coverage of the Oscar-winning Louisville native in our exclusive Jennifer Lawrence Diary™. Today’s news, rated on a scale of 1-5 stars:

![]() Multiple offers are already on the table for the drama starring Jennifer Lawrence, about controversial Silicon Valley entrepreneur Elizabeth Holmes. And that’s even before a round of pitches Monday as director Adam McKay nears a final decision, according to Deadline.

Multiple offers are already on the table for the drama starring Jennifer Lawrence, about controversial Silicon Valley entrepreneur Elizabeth Holmes. And that’s even before a round of pitches Monday as director Adam McKay nears a final decision, according to Deadline.

The Hollywood trade publication revealed only last week that Lawrence and McKay would be teaming on the project, and a package of background materials was sent to numerous buyers just yesterday morning.

The sizzling competition among producers is hardly surprising. Lawrence, 25, is Hollywood’s most bankable star, and McKay won an Oscar this year for co-writing and directing another hot-button film, The Big Short.

Deadline’s got the background:

Holmes, 32, launched Theranos in 2003, with claims it could test blood with only a pinprick vs. the traditional method of drawing blood by injection. That pumped up the company’s valuation to $9 billion as recently as two years ago. The company has since come under investigation over claims of inaccurate testing. And Holmes’ own worth — at one point valued at $4.5 billion for her 50% stake — has fallen to a fraction of that.

Big smiles, big personalities and big business networking — yes, it’s everyone’s favorite feature in the society shiny sheets: party photos! Boulevard picks through the pics, choosing our favorite coverage.

Our julep cup hasn’t exactly been runneth overing when it comes to the party photo scene — especially for a city whose financial pedigree includes three sin industries: tobacco, booze, and gambling.

Our julep cup hasn’t exactly been runneth overing when it comes to the party photo scene — especially for a city whose financial pedigree includes three sin industries: tobacco, booze, and gambling.

But just in the nick of time, along comes our favorite society scribe: Carla Sue Broecker of The Voice-Tribune and her newest Party Line column. This week’s entry and Boulevard’s pick of the pics: the fourth annual Bourbon by the Bridge fundraiser held last weekend. The beneficiary is amazing: CASA (Court Appointed Special Advocates) of the River Region, which serves hundreds of abused and neglected kids every year.

As the fundraiser’s name suggests, there was some bourbon there. Specifically: Angel’s Envy, Barton 1792, Boundary Oak Distillery, Buffalo Trace, Copper & Kings, Four Roses, Heaven Hill, Jefferson’s, Kentucky Moonshine, Michter’s, Rivulet, Town Branch, Wild Turkey, Willett, Rabbit Hole, and Woodford Reserve (photo, top).

More than 400 guests turned out — including two of the most attractive people to grace a Voice-Tribune photo gallery in, oh, forever: Amy Munno and actor Adam Raque, who each possess bazillion-watt smiles. Flip through the 26 pics, then put on your Jackie O. shades before you hit No. 24. In the meantime, here’s Raque on Instagram:

Brown-Forman chief executive Paul Varga‘s fiscal 2016 pay was down from $11 million the year before and $12.3 million two years prior, the company disclosed in its annual shareholders proxy report.

Compensation for the other four highest-paid executives was mixed vs. the year before, according to the report, which the Louisville whiskey distilling giant filed with the Securities and Exchange Commission late this afternoon.

The figures appear on Page 40, and cover the year ended April 30. In addition to Varga, they include CFO Jane Morreau; Mark McCallum, president of the marquee Jack Daniel’s brand; Jill Jones, executive vice president over North America and Latin America regions, and General Counsel Matthew Hamel.

Chairman George Garvin Brown IV got paid non-equity incentive compensation of $531,787 plus a small salary of $38,750. (“Non-equity incentive compensation” sounds like a cash bonus, but for some reason, Brown-Forman doesn’t use that term.)

In fiscal 2015, Brown’s non-equity incentive pay was much less: $281,845, according to last year’s proxy report. But that year he was still working as an executive vice president in addition to his chairman’s duties. For his EVP work, he was paid $320,427. He left that job a year ago today.

The company also said it incurred $18,359 for certain expenses associated with Brown’s living abroad, and other employee benefits provided to him. The proxy report doesn’t say where Brown, 47, was living at the time. (London, it appears, based on this Globe and Mail story last year.)

The Browns are firmly in charge

The Brown family controls Brown-Forman through their enormous stock portfolio, preserved through multiple generations — at least four — that followed George Garvin Brown, a pharmaceuticals salesman who started the company in Louisville in 1870. At current market prices, the family’s holdings are worth at least $6 billion — but in reality, much more.

The holdings are divided between the company’s two classes of stock: “A” shares, which carry voting rights, and non-voting “B” shares. Both classes trade on public markets, although for different prices. The family owns at least 67% of the A shares, according to the proxy report.

Chairman Brown and his brother, Campbell Brown — who’s also a senior executive at the company — hold one of the family’s single-biggest stakes: 6.8 million class A shares, through an entity called the G. Garvin Brown III Family Group. At today’s closing price of $105.48, those shares are worth $718 million.

Campbell, 48, has been president and managing director of Old Forester, the company’s founding bourbon brand, since 2015.

Keeping business in the family

Another big stockholder is Laura Lee Brown, who with her husband Steve Wilson, founded the trendy 21c Museum Hotel chain in Louisville. She owns 2.2 million class A shares outright, worth $233 million at current prices.

In the proxy report, Brown-Forman said it did business with the couple, as it has in previous years. It includes developing historic Whiskey Row on Main Street into a complex of new lofts, retail and restaurant space to be called 111 Whiskey Row. The company paid $900,000 to a company controlled by the couple: Brown Wilson Development, according to the proxy report.

The project was heavily damaged in a fire last summer, but was saved and work continues.

Brown-Forman also paid the couple $267,395 for rooms, meals and other entertainment at their 21c hotel and its Proof on Main restaurant. It also paid them another $250,440 for leases on parking spaces in a garage they own adjoining Brown-Forman’s downtown offices.

Unraveling founding family’s wealth

Valuing the Brown family’s total stock holdings is difficult. Individual members own shares outright. They also have partial, beneficial ownership through family partnerships and legal entities. Because they overlap with other family members, it’s hard to assign a value to them.

However, counting each share just once among family members owning more than 5% of all outstanding shares, their combined total is about 57 million, worth $6 billion. But that only covers shares held by the single-biggest owners who, under Securities and Exchange Commission rules, are required to disclose holdings exceeding 5%. There may be other Browns sitting on multimillion-dollar positions, undisclosed because they don’t meet the 5% threshold.

And that’s only counting the class A shares. The Browns own several million non-voting B shares, too. Determining exactly how many is tricky, but tables and footnotes in the proxy report offer clues.

For example, Garvin Brown IV and his brother Campbell together own 1.3 million Class B shares outright; at today’s closing price of $97.90, they’re worth another $125 million. Adding that to their A shares, the brothers own $843 million in stock.

Sandra Frazier, who just cycled off the board of directors, owns 373,376 B shares plus 1.4 million A shares. They’re worth a total $185 million. Frazier, 44, is CEO of Tandem Public Relations in Louisville, which she founded in 2005. She’s also a member of the board of directors at Glenview Trust Co., a boutique wealth management company that serves 500 of the richest families in the area.

Her first cousin, Laura Frazier, joined the Brown-Forman board when Sandra left. Laura owns 239,829 B shares and 225,433 A shares. Combined, they’re worth $47.3 million. In addition to being a director, Laura, 58, owns Bittners, the high end furniture and decorating company in NuLu.