A news summary focused on 10 big employers; updated 4:34 p.m.

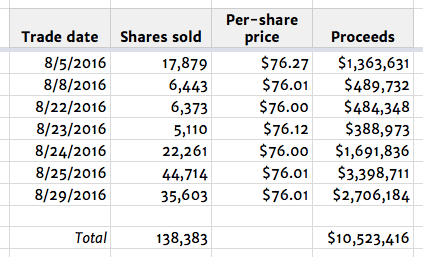

PAPA JOHN’S stock traded at a new 52-week high, $78.49, today before easing back to close at $78.26, up 49 cents. The stock’s all-time trading high was $79.40, on July 13, 2015 (Google Finance). Papa John’s founder and CEO John Schnatter is the pizza chain’s single-biggest stockholder, with about 10.5 million shares, including options — a stake worth $822 million at today’s closing price.

UPS plans to hire about 2,500 seasonal workers in Louisville to handle extra business during the holiday shipping period that begins in November and extends through January. The full- and part-time seasonal positions — primarily package handlers, drivers and driver-helpers — are among 95,000 seasonal workers overall the shipper plans to take on. Seasonal jobs have long been an entry for permanent ones at the company; from the 2012 through 2014 holiday seasons, more than 37% of those hired for seasonal package handler jobs were later hired in a permanent position when the holidays were over, the company says. UPS is the single-biggest private employer in Louisville, with about 22,000 workers at its hub at Louisville International Airport. Around the world, the company has 440,000 employees (press release and Courier-Journal). More about UPS.

FORD will move all the company’s small-car production to lower-cost Mexico over the next two to three years, CEO Mark Fields told an investor conference yesterday. The automaker produces its Fiesta subcompact in Mexico, but its Focus and C-Max small cars are made in suburban Detroit. The company is building a $1.6-billion assembly plant in Mexico’s San Luis Potosi, and plans to make small cars there starting in 2018 (Los Angeles Times). In Louisville, Ford employs nearly 10,000 workers at truck and auto assembly factories.

In other news, 21c Museum Hotel has sold a minority interest to a real estate investment unit of J.P. Morgan Private Bank. Under the deal, Junius Real Estate Partners will invest up to $250 million in the Louisville-based boutique chain toward building or acquiring new hotel properties.

Their first joint venture will be a 21c Museum Hotel Nashville in the historic downtown Gray & Dudley Building; it’s expected to open in the first half of next year with 124 hotel rooms, more than 10,500 square feet of museum and event space and five rooftop-level rooms, including two suites, with private terraces. 21c will manage the property and have joint ownership.

Launched in 2006 by Continue reading “Papa John’s shares at new 52-week high; UPS forecasts 2,500 seasonal workers for 2016 holiday shipping; and 21c Museum Hotel in $250M deal with JP Morgan unit”

BROWN-FORMAN‘s Jack Daniel’s has unveiled a new version to celebrate its major birthday this year: Jack Daniel’s 150th Anniversary Whiskey, which is priced around $100 per one-liter bottle (

BROWN-FORMAN‘s Jack Daniel’s has unveiled a new version to celebrate its major birthday this year: Jack Daniel’s 150th Anniversary Whiskey, which is priced around $100 per one-liter bottle (