A news summary, focused on 10 big employers; updated 10:42 p.m.

Tightening his grip on the University of Louisville, Gov. Matt Bevin today added 10 more members to his reconfigured board of trustees, appointing a slew of business heavy hitters, including at least one with long family ties to the board.

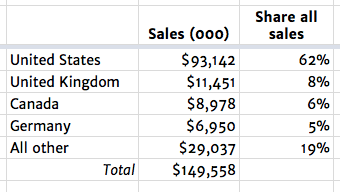

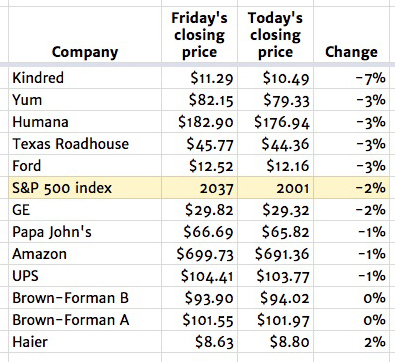

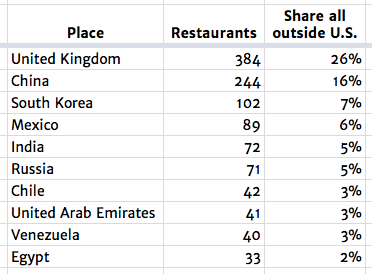

Among them: Papa John’s founder and CEO John Schnatter; Glenview Trust Co. founder and chairman David Grissom, who’s also a retired Humana executive; and Brown-Forman heiress Sandra Frazier.

Schnatter is a major UofL booster, donating millions for naming rights to Papa John’s Cardinal Stadium. He and conservative industrialist Charles Koch donated $6.3 million to the school in March 2015 to establish an on-campus center to study the virtues of free enterprise; responding to criticism, the university said the money wouldn’t curtail academic freedom.

Frazier, who is now cycling off the Brown-Forman board of directors, also is a director of Glenview Trust, a boutique investment firm that serves more than 500 of the area’s wealthiest families. Her late father, Harry Frazier, is a former UofL vice chairman, and her uncle, the late Owsley Brown Frazier, was once chairman.

Two other Bevin appointees are private equity and venture capitalists, according to The Courier-Journal: Dale Boden, now a partner with Weller Equity; and Douglas Cobb, who co-founded Chrysalis Ventures with David A. Jones Jr., a Humana director. Jones’ father, David Sr., co-founded Humana and is also a Glenview Trust director. The 10-member Glenview board comprises some of Louisville’s biggest power brokers.

Here’s Bevin’s order, with the full list of appointees and their terms.

Bevin’s announcement today follows his surprise June 17 dismissal of the previous 20-seat board, which he called “dysfunctional” in its oversight of the university and President James Ramsey. He replaced them with an interim three-member board, which he filled out with today’s appointments. The school has been roiled with controversy over Ramsey’s seven-figure compensation; a sex scandal involving the marquee men’s basketball program, plus other administrative missteps. Ramsey offered to resign when Bevin dissolved the board, but a final decision on his future was deferred to the next board.

Salt Lake City police arrested a man Thursday on suspicion of robbing “several” Papa John’s restaurants just outside the Utah city during a robbery spree this month involving as many as 20 businesses.

Salt Lake City police arrested a man Thursday on suspicion of robbing “several” Papa John’s restaurants just outside the Utah city during a robbery spree this month involving as many as 20 businesses.