Boulevard focuses on news about some of Louisville’s biggest employers, nonprofits, and cultural institutions. This is one in an occasional series about them.

Kindred Healthcare traces its history to the 1985 launch of a predecessor, Vencor, that ran long-term acute care hospitals. By 1999, Vencor had morphed into a much bigger enterprise, with 300 nursing homes and 60 hospitals — and too much debt. Then it got clobbered when the federal government cut Medicare payments at a time when they accounted for 30% of a typical nursing home’s revenue.

Unable to pay its bills, Vencor sought Chapter 11 bankruptcy court protection in September 1999 after suffering staggering losses: $600 million in the fourth quarter of 1998 and $64 million in the first half of 1999, according to The New York Times. Vencor warned shareholders that its very survival was at stake.

But less than two years later, April 2001, it emerged from court protection with a new name, Kindred, and a new business plan. It is now a stronger and bigger company that sums up its operations in a very long sentence:

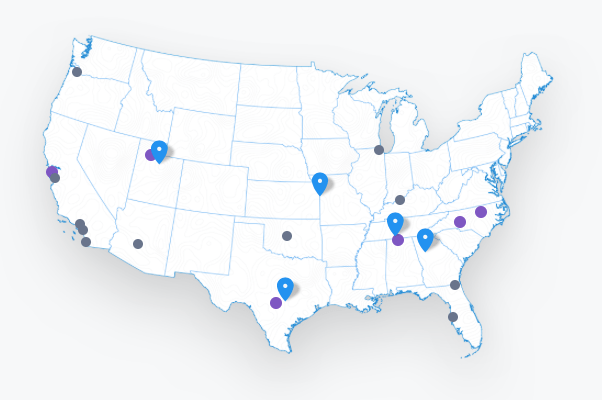

“Kindred through its subsidiaries had approximately 102,000 employees providing healthcare services in 2,692 locations in 46 states, including 95 transitional care hospitals, 18 inpatient rehabilitation hospitals, 90 nursing centers, 19 sub-acute units, 604 Kindred at Home home health, hospice and non-medical home care sites of service, 100 inpatient rehabilitation units (hospital-based) and a contract rehabilitation services business, RehabCare, which served 1,766 non-affiliated sites of service.”

Considerable growth came last year when Kindred completed its $1.8 billion takeover of Gentiva Health Services, a big Atlanta-based provider of hospice services, at-home nursing care and physical therapy. That deal was announced in October 2014.

Kindred is one of only four Louisville companies in the Fortune 500 list of biggest businesses. In June 2016, it was ranked No. 372 — a big leap up from 491 in 2015. (The other three in Louisville are Humana, No. 52; Yum Brands, 218; and Brown-Forman, 702.)

Kindred is still growing. It broke ground this year on an expansion of its headquarters at Fourth and Broadway, to house up to 500 new employees in the years ahead. The company is led by CEO Benjamin Breier.

Not to be missed: Kaleidoscope, an online gallery of writing, photography, and other artwork created by Kindred’s patients and residents.

In other news, Bardstown Road is getting another craft beer restaurant:

In other news, Bardstown Road is getting another craft beer restaurant:

Finally, Louisville native and Oscar winner Jennifer Lawrence may star opposite Sandra Bullock in an all-female remake of the “Ocean’s 11” franchise; the last sequel was “Ocean’s 13.” (

Finally, Louisville native and Oscar winner Jennifer Lawrence may star opposite Sandra Bullock in an all-female remake of the “Ocean’s 11” franchise; the last sequel was “Ocean’s 13.” (