A news summary, focused on big employers; updated 9:52 a.m.

HUMANA: Aetna sold $13 billion of new bonds yesterday to pay for its $34 billion purchase of Humana, the latest sign of growing confidence anti-trust regulators will OK the deal. Shares of both insurance giants jumped on the news, narrowing the discount at which Humana trades to the original $230 cash-and-stock offer price. That gap, around 17% at yesterday’s close, is the smallest since early April (Wall Street Journal). Humana’s stock surged 5.5% to $187.23; Aetna, up 4% to $120.05. Aetna’s CEO said recently that he expects the deal announced last July will close in the year’s second half. Humana employs about 12,500 workers in Louisville, part of its nationwide workforce of 50,000; that figure would double under the Aetna deal. More about Humana’s history.

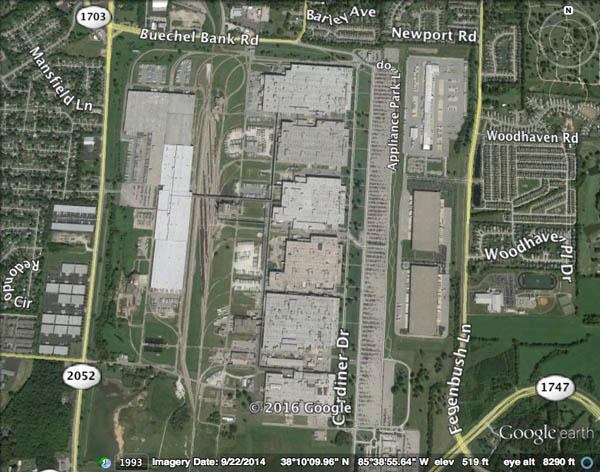

GE: Haier Co. is expected to close on its $5.4 billion purchase of the iconic 50-year-old Appliance Park as soon as Monday. That would “sever Louisville’s half-century ties to General Electric,” The Courier Journal says, “and turn over ownership of one of the community’s flagship employers to a major Chinese appliance and consumer electronics maker” (Courier-Journal). The complex employs 6,000 making dishwashers and other home appliances. Still, GE is advertising jobs there starting at $15.51 and hour, or $32,000 a year (company website).

(Here’s how Google translates our GE news summary in simplified Chinese: 海尔股份有限公司有望尽快结束其$5.4十亿收购标志性的50岁的家电园区,截至周一。这将“切断路易斯维尔半个世纪关系到通用电气,”信使杂志说,“和社会各界的旗舰雇主之一的所有权移交给大中国家电和消费电子制造商”(信使报)。复杂的员工6000人。 GE尚广告工作开始出现在$15.51和时间,或每年$32,000.” Our headline should say: Goodbye, GE!)

Watch an inside tour of Appliance Park:

YUM: Retired PepsiCo CEO Roger Enrico, who spun off the company’s restaurant division into what is now Yum Brands, died suddenly Wednesday while on vacation with his family in the Cayman Islands. The cause of his death wasn’t immediately known. He was 71 (The Drum). CEO from 1996-2001, Enrico was known for turning Pepsi-Cola into a pop-culture leader with groundbreaking sponsorships with Michael Jackson and Madonna in the “Choice of a New Generation” campaign (The Wall Street Journal and AdAge). Watch one of the Jackson commercials. Yum’s history in Louisville started with KFC founder Harland Sanders.

AMAZON: About 40 bike messengers employed by Amazon contractor Fleetfoot Messenger Service have been laid off, effective today, as the company rethinks the way it makes quick deliveries in its corporate hometown of Seattle. The messengers carried packages and groceries for Amazon Prime Now, a popular one- to two-hour service seen as one of Amazon’s big bets to beat brick-and-mortar retailing (Seattle Times). Geekwire said the number laid off was closer to 60, and quoted one saying: “A lot of people, including myself, are thinking, ‘Why are we going to stick around and bust our ass and put our lives on our line when they don’t give a shit?’ They just cut our jobs. A lot of us just walked out” (GeekWire). Expectations were high for the couriers — with heavier-than-normal loads, fast delivery times, careful tracking, and demands for near-perfect execution (GeekWire, earlier). Elsewhere in Amazonia, the company blows away all competitors in time spent on their mobile websites by a long shot; mobile visitors spent an average 103 minutes on Amazon vs. Target’s 20 minutes and Walmart’s 14 (Business Insider).

BROWN-FORMAN: Billy Walker, who sold the BenRiach Distillery Co. scotch whiskey business to Brown-Forman for $405 million million, has been named entrepreneur of the year in the Scotland Food & Drink Excellence Awards; the deal closed Wednesday (Herald Scotland).

CHURCHILL DOWNS: Hosting a party at the iconic racetrack runs from casual to a formal sit-down meal surrounded by historic racing décor (press release via Insider Louisville).

In other news, U.S. employers added only 38,000 workers in May, a significant slowdown in hiring that could push back a decision by the Federal Reserve to raise interest rates (New York Times). Wall Street wasn’t keen on the report; all major stock indices retreated (Google Finance) and the 11 big employers in Boulevard’s Stock Portfolio all tumbled.

Finally, Louisville native and humanitarian Muhammad Ali has been hospitalized again and is being treated for a respiratory issue in Phoenix, where he lives. Ali, 74, has been battling Parkinson’s disease for years. The Associated Press said last night that his condition may be more serious than in his previous hospital stays (ESPN). His $80 million Muhammad Ali Center opened in downtown Louisville in 2005.

We like to remember him for his stunning Sonny Liston knockout punch after 104 seconds on May 25, 1965:

Embed from Getty Images

FORD recalled 1.9 million vehicles with certain Takata passenger-side frontal airbag inflators after Takata said the inflators were defective. The vehicles affected are 2007-2010 Ford Edge; 2006-2011 Ford Fusion; 2005-2011 Ford Mustang; 2007-2011 Ford Ranger; 2007-2010 Lincoln MKX, and 2006-2011 Lincoln MKZ, Zephyr and Mercury Milan (

FORD recalled 1.9 million vehicles with certain Takata passenger-side frontal airbag inflators after Takata said the inflators were defective. The vehicles affected are 2007-2010 Ford Edge; 2006-2011 Ford Fusion; 2005-2011 Ford Mustang; 2007-2011 Ford Ranger; 2007-2010 Lincoln MKX, and 2006-2011 Lincoln MKZ, Zephyr and Mercury Milan (

In other news, KMAC has postponed its reopening until July 1 because of construction delays. The $3 million renovation of the arts and crafts museum will streamline 20,000 square feet of exhibition space and 6,000 square feet of public area at its historic location at 715 West Main St. (

In other news, KMAC has postponed its reopening until July 1 because of construction delays. The $3 million renovation of the arts and crafts museum will streamline 20,000 square feet of exhibition space and 6,000 square feet of public area at its historic location at 715 West Main St. (