A news summary focused on 10 big employers; updated 8:18 p.m.

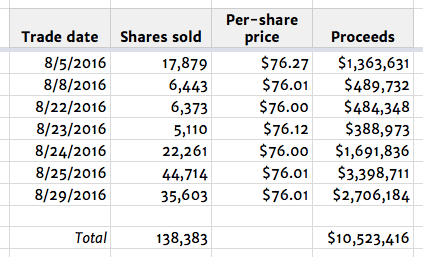

PAPA JOHN’S CEO John Schnatter sold another 4,736 shares of company stock for $360,000, at around the same per-share price he’s been fetching since he began selling aggressively in early August: $76, according to a Securities and Exchange Commission filing this afternoon. The latest sale, which was on Friday, brought to $10.9 million his total proceeds over the past month (SEC document). Papa John’s PZZA stock closed at $75.96 a share today, up 21 cents.

PIZZA HUT: Private equity investor Allegro and three local fast-food management veterans are taking over Pizza Hut’s 250-unit master franchise in Australia; terms, including a price, haven’t been announced. Pizza Hut has about 10% of the $4 billion takeaway food market in Australia, according to industry analyst IBISWorld. The deal will “accelerate growth and deliver Pizza Hut to more consumers across Australia,” says outgoing Pizza Hut Australia General Manager Graeme Houston. Corporate parent Yum will retain its KFC outlets in the country (Business Insider). The deal is the latest foreign market shift for corporate parent Yum, which last week said it agreed to an advance sale of a $464 million slice of its China operations to a prominent Chinese deal maker and the financial affiliate of Chinese Internet giant Alibaba ahead of next month’s planned spinoff of the China Division.

PIZZA HUT: Private equity investor Allegro and three local fast-food management veterans are taking over Pizza Hut’s 250-unit master franchise in Australia; terms, including a price, haven’t been announced. Pizza Hut has about 10% of the $4 billion takeaway food market in Australia, according to industry analyst IBISWorld. The deal will “accelerate growth and deliver Pizza Hut to more consumers across Australia,” says outgoing Pizza Hut Australia General Manager Graeme Houston. Corporate parent Yum will retain its KFC outlets in the country (Business Insider). The deal is the latest foreign market shift for corporate parent Yum, which last week said it agreed to an advance sale of a $464 million slice of its China operations to a prominent Chinese deal maker and the financial affiliate of Chinese Internet giant Alibaba ahead of next month’s planned spinoff of the China Division.

KFC: In a U.K. court, a former 30-year-old KFC worker was spared jail time after admitting he stole $14,700 from a KFC franchise by processing thousands of fake customer coupons for popcorn chicken. For more than a year starting in January 2015 James Anderson of Basildon, 32 miles southwest of London, pretended to hand money back to customers for the $2.65 snacks, but pocketed the cash instead. He said he wanted the money to contribute to his upcoming wedding. Anderson’s supervisors became suspicious after noticing a high number of refunds being processed under his cash-register ID number (Halstead Gazette).

BROWN-FORMAN will inaugurate new, higher-profile free-standing exhibition space at this year’s TFWA World Exhibition & Conference next month in Cannes. The new Brown-Forman area is more than double the size of the Louisville spirits and wine giant’s former stand and has informal gathering space as well as a large number of meeting tables and four meeting rooms, said Marshall Farrer, vice president and managing director for global travel-retail. The company will join more than 3,000 other brands at the annual duty-free travel-retail meeting Oct. 2-7 at Canne’s Palais convention center (DFNI).