A news summary, focused on 10 big employers; updated 6:18 p.m.

Those employers’ shares closed higher today, as overall U.S. stocks clawed back half the ground lost after Britain’s surprise vote Thursday to quit the European Union. It was the second rally in two days on Wall Street, which had been rattled since Friday by uncertainty over the so-called Brexit. Britain’s stock market also has recouped losses in the same stretch, although other major markets in Europe and Asia have yet to bounce back fully, according to The Associated Press.

The three major U.S. stock indices all closed higher. The Dow Jones Industrial Average rocketed 285 points, or 1.6%; the S&P 500, 35 points or 1.7%, and the Nasdaq, 87 points or 1.9%, according to Google Finance.

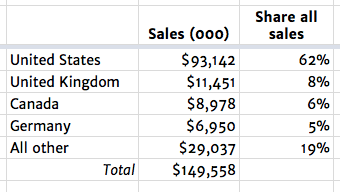

Here are today’s closing prices for the 10 employers tracked by Boulevard:

- Amazon: rose $7.65 or 1%

- Brown-Forman: class A, $2 or 1.3%; and B shares, $1.78 or 1.8%

- Ford: 15 cents or 1.3%

- GE: 60 cents or 2%

- Humana: 70 cents or 0.4%

- Kindred: 53 cents or 5%

- Papa John’s: $1.35 or 2%

- Texas Roadhouse: 79 cents or 1.8%

- UPS: $1.65 or 1.6%

- Yum: $1.44 or 1.8%

In non-Brexit news:

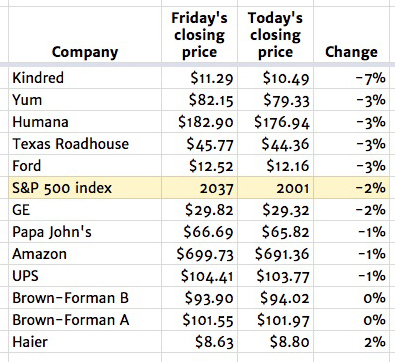

AMAZON: Walmart today launched a free 30-day trial of ShippingPass, its two-day shipping program to all U.S. consumers, as the world’s biggest retailer ratchets up the competition with Amazon’s Prime subscription service. ShippingPass costs $49 a year, half as much as Amazon’s $99 (Reuters and press release). Also today, Amazon slashed prices up to 50% on newly released, full-featured, unlocked Android smartphones for Prime members (company website). Amazon employs 6,000 workers in the Louisville area, at distribution centers in Jeffersonville, and in Bullitt County’s Shepherdsville.

KINDRED: Senior Vice President John Lucchese sold 4,341 shares for about $11.39 a share today for a total $49,000, the company said in a Form 4 regulatory filing (SEC document). Kindred shares closed this afternoon at $11.43, up 5%.

GE: U.S. regulators rescinded stricter oversight of the company’s finance arm, GE Capital, after saying the conglomerate had made changes that significantly reduced its threat to U.S. financial stability (Wall Street Journal). Its former residential home appliance business, now owned by Haier Group, employs 6,000 workers in Louisville.

In other news, U.S. Rep. John Yarmuth of Louisville has once more donated his entire congressional salary — $174,000 — to charity, making good on a campaign promise when he was first elected a decade ago. The 17 recipients include three arts and humanities groups: Louisville’s Fund for the Arts, Louisville Orchestra, and the Muhammad Ali Center (WDRB).