A news summary focused on 10 big employers; updated 4:03 p.m.

YUM: Two of what may be the only serious bidders for Yum’s mammoth China Division have submitted offers — including one for just $2 billion — but have failed to reach a final agreement for a business once expected to command $10 billion, according to The Financial Times. The bidders are China-based private equity fund Primavera and Singapore sovereign wealth fund Temasek.

Primavera made the $2 billion offer for part of the franchise, people briefed on the talks said. “The bid conformed to Yum’s original conditions for the sale, but the buyout group and Yum could not agree on pricing,” the FT says.

Temasek also made an offer — the newspaper didn’t say how much — but also couldn’t reach an agreement on the 7,200 KFC and Pizza Hut units. They accounted for more than half Yum’s revenue last year.

The Louisville-based fast food giant put the China operations on the auction block last year after being pressured to do so by investors including Corvex Management founder Keith Meister. CEO Greg Creed is preparing to lead a road show that Yum expects will end with a spinoff by Oct. 31.

But the FT’s report raises doubts about the timetable, particularly after Bloomberg News reported that a consortium of the only other known bidders dropped out in May: private equity firm KKR and Chinese state investor CIC.

A company spokesperson whom the FT didn’t identify said Yum is “making great progress toward the separation of our China business,” which last year accounted for 61% of Yum’s $11.1 billion in revenue and 39% of $1.9 billion in profits.

The FT’s report was published yesterday. This afternoon, Wall Street wasn’t worried; Yum’s stock closed less than 1% higher, or 47 cents, to $89.72 — just below its record trading high of $90.38 on Monday (FT).

BROWN-FORMAN: Racing to meet consumer demand for whiskey, U.S. farmers planted 1.76 million acres of rye for the 2016-17 season, the most since 1989 and a 12% increase from a year ago. Planted in autumn and harvested in mid-summer, rye fell out of favor over the past decade as other crops produced bigger profits (Reuters).

In Nashville yesterday, Jack Daniel’s officially opened its second retail store — the first in its 150-year history outside the distiller’s corporate hometown of Lynchburg. “We get about 275,000 visitors that come see us every year, and there’s certainly a lot more people in this world, and we’d like to take Lynchburg to them,” said Dave Stang, director of events and sponsorships. The store doesn’t sell its namesake liquor :(, but does sell Jack Daniel’s-branded merchandise (News Channel 5).

Meanwhile, the Jack Daniel’s Barrel Hunt promotion is coming to South Africa as part of the distiller’s 150th anniversary — a global scavenger hunt to find 150 handcrafted barrels at historic and cultural sites (Biz Community). Clues for the next barrel, in Lithuania’s Kaunas, will be revealed tomorrow. The most recent found was in the U.K.’s Manchester; still to be found: barrels in Prague and Riccione, Italy. How the hunt works.

And Brown-Forman stockholders hold their annual meeting tomorrow at 9:30 a.m. in the company’s Louisville headquarters conference center at 850 Dixie Highway. Board Chairman Garvin Brown IV will oversee the meeting. On the agenda, according to the proxy statement:

- Electing 12 directors to the board. They include three new members initially elected this spring, all fifth-generation members of the Brown family controlling the company. They are Campbell P. Brown, Marshall B. Farrer, and Laura L. Frazier.

- Voting on a proposal to amend the Restated Certificate of Incorporation to increase the number of authorized shares of Class A common stock in connection with the company’s previously announced two-for-one stock split.

GE/HAIER: In Everett, Wash., a Daily Herald reader takes issue with a recent article quoting GE CEO Jeffrey Immelt about factory jobs returning to the U.S., in this case jobs building GE Appliances refrigerators in Louisville. Bob Weiss writes in a letter to the editor: “The problem I have with this is Immelt no longer has anything to do with decisions made by GE’s appliance division. That portion of GE’s manufacturing has been sold to a Chinese company, Haier. . . . On the plus side, maybe those workers will be better treated by a Chinese company than they were by GE” (Daily Herald).

Immelt was speaking to New York Times correspondent Froma Harrop about GE’s moving 4,000 jobs from China and Mexico to a new appliance plant in Louisville. “We have [only] two hours of labor in a refrigerator,” Immelt said, “so it really doesn’t matter if you make it in Mexico, the U.S. or China.” GE sold the appliances division to Haier last month for $5.6 billion.

AMAZON just announced plans to build an 800,000 square-foot distribution center in Jacksonville, Fla., with 1,500 employees to start. The retailer didn’t give a timetable for its opening, however (press release). In the Louisville area, Amazon employs 6,000 workers at centers in Jeffersonville and Shepardsville. The company has other centers in Campbellsville, Hebron and Lexington — making Kentucky one of the biggest overall distribution centers in the U.S. About Amazon in Louisville.

Also this morning, in Scotland, Amazon said it’s begun offering one-hour delivery on more than 15,000 items to Prime subscribers in Glasgow (Engadget).

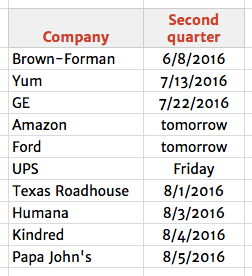

Amazon and FORD — two of the 10 big employers tracked by Boulevard — report second-quarter results tomorrow. At least three more report next week. (Note: In the table below, PAPA JOHN’S is the estimated release date; here’s the pizza chain’s investor relations site.) The lineup:

In other news, Courier-Journal owner Gannett Co.’s stock plunged 9%, or $1.35, closing at $13.01 a share after trading as low as $12.67 earlier in the day. The newspaper giant reported second-quarter earnings shy of Wall Street expectations, and lower-than-forecast revenue (MarketWatch and press release).

Shares are well below their 52-week high of $17.91. The stock’s all-time low — $10.75 a share — was July 6, 2015, after the all-newspaper company was spun off a week before from its sister TV stations and digital properties.

On the company’s earnings teleconference with analysts this morning, CEO Bob Dickey said it remains “bullish” on its acquisition strategy and “continues to have a very robust pipeline” of further deals. “We could see something between another 15 to maybe 30 titles,” he said. “We are also exploring some opportunities in the digital space” (Wall Street Journal).

With the CJ and flagship USA Today, Gannett owns 109 dailies with nearly 19,000 employees in the U.S. and U.K. The TV and digital properties are now owned by a company called Tegna; WHAS in Louisville is one of them.

Also today, Boulevard launched the Gannett Watercooler for the first time, an ope-topic comment forum where employees at the CJ and other Gannett dailies can post news and workplace gossip.