Lexington Mayor Jim Gray won the Democrats’ nomination for U.S. Senate yesterday by campaigning on his experience helping save the family’s Gray Inc. construction company after his father’s death. He’ll now face Republican Sen. Rand Paul in November — a contest he concedes will be tough.

“I have no illusions about it being a challenging race,” he told the Lexington Herald-Leader, “but I’ve got the experience and I’ve got the record. That experience is in the private sector, in building a family business.”

In the race to the senate, Gray, 62, joins other well-heeled candidates who’ve run on business bona fides, including Gov. Matt Bevin and White House hopeful Donald Trump. Gray’s first financial disclosure report, filed last month, offers a glimpse at that record.

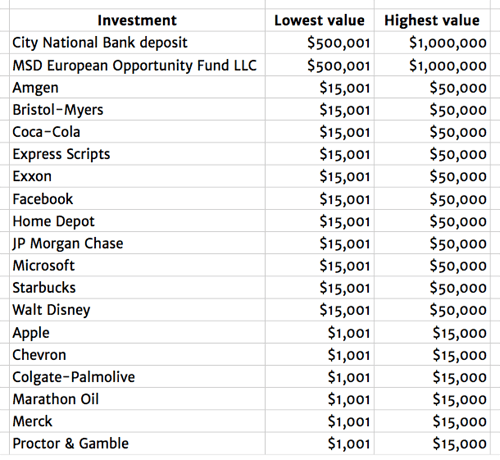

The April 15 report covers the period extending back to the start of 2015. As with all such reports candidates and office holders must file annually, Gray’s assigns only a range of values for his family’s business, real estate and stock holdings. An individual stock, for example, may be valued at between $15,001 and $50,000 — the value Gray gave to his investment in the biotech giant Amgen. What’s more, it’s a point-in-time view; there’s no way to know the value of any of the assets today, nor whether they’re even still owned.

Still, Gray’s report offers a revealing snapshot of his family’s more big-ticket assets:

- Gray Inc.: valued between $5 million and $25 million

- Gray Realty commercial property: $1 million to $5 million

- Woodford Realty commercial property: $250,000 to $500,000

- Visual and Antiquity Investments, which consists of contemporary paintings, sculptures, mixed media and rare books: $1 million to $5 million. The report doesn’t say whether this is a private collection or commercial venture

The report also lists stocks and other investment securities, with a combined value between $1.8 million and $4.1 million. The portfolio includes a mix of technology stocks (Apple and Facebook); pharmaceuticals (Bristol-Myers and Merck, in addition to Amgen) and consumer goods (Starbucks and Walt Disney). A partial list:

Finally, Gray also reported annual wages of $160,000 as mayor, and $125,000 from Gray Inc., where he’s non-executive board chairman.

Related: Watch Gray’s “American Dream” campaign video about saving the family business.

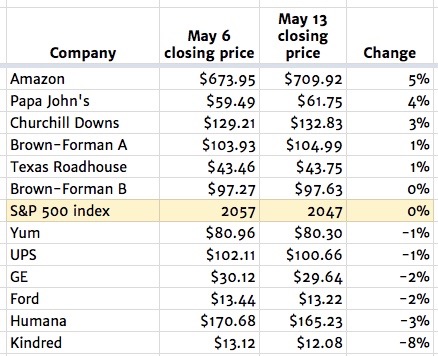

BROWN-FORMAN is reportedly considering a sale of Finlandia vodka amid a broader effort to focus on its whiskey business; the company spent $200 million to assemble the vodka business from 2000 to 2004. Brown-Forman declined to comment on the report (

BROWN-FORMAN is reportedly considering a sale of Finlandia vodka amid a broader effort to focus on its whiskey business; the company spent $200 million to assemble the vodka business from 2000 to 2004. Brown-Forman declined to comment on the report (