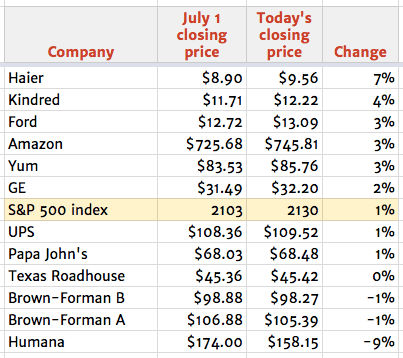

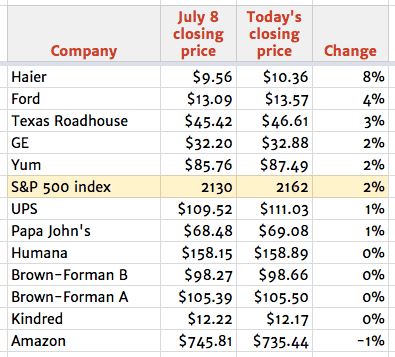

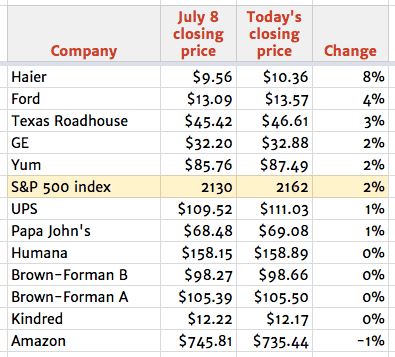

Shares of big employers in the Boulevard Stock Portfolio, ranked by weekly performance at today’s closing price, with the S&P 500 index for comparison.

Shares of big employers in the Boulevard Stock Portfolio, ranked by weekly performance at today’s closing price, with the S&P 500 index for comparison.

Here’s how we’re getting more and more inured to terrorism: The stock markets now barely flutter after rampages like what happened last night in Nice.

A news summary, focused on 10 big employers; updated 5:34 p.m.

TACO BELL this afternoon announced plans to build a two-story 24-hour flagship Cantina in Las Vegas right on the Strip at East Harmon Avenue, across from CityCenter and The Cosmopolitan Hotel; it’s expected to open this fall and will be the third in the growing Cantina division. Like other Cantinas, the Las Vegas restaurant will serve alcohol, including beer and Twisted Freezes slushies. Taco Bell introduced the Cantina concept last year with two urban locations, in a bid to draw younger diners with a more tech-focused ordering system and design. Of the 2,000 Taco Bell restaurants planned to be built by 2022, 200 will be urban locations, a typically underrepresented geography for the brand (press release).

Cantina debuted in Chicago last September, and a San Francisco outpost followed a few weeks later. After Las Vegas, Taco Bell plans to take the concept to Atlanta, and further expansion is in the works for college towns and dense urban areas across the country (Eater). Twisted Freezes come in three flavors: Taco Bell’s proprietary Mountain Dew Baja Blast (blue), Cantina Punch (red), and Margarita (green). Patrons can add their choice of rum, tequila or vodka (Chicago Eater).

PIZZA HUT announced a new artificial intelligence chatbot that works within Facebook Messenger, and on Twitter, part of a massive roll-out the company is calling “social media ordering.” Chief Digital Officer Baron Concors demonstrated the chatbot at MobileBeat 2016 during a session on chatbot innovations. The new bot can handle pizza and other food delivery orders from customers who have Pizza Hut accounts, streamlining the process, improving accuracy, and eliminating wait-times. It will be available starting next month (Venture Beat and press release).

HUMANA‘s stock closed moments ago at $154.65 a share, up less than 1% — still, the first up day since news broke last week that the insurer and Aetna of Hartford were struggling to keep their $37 billion merger on track during an unexpected meeting with the Justice Department. Aetna’s stock fell less than 1%, closing at $115.50 (Google Finance). None of the parties in the DOJ negotiations Friday have publicly disclosed the outcome. Humana has 12,500 employees in Louisville.

AMAZON: Some shoppers encountered a glitch Continue reading “Taco Bell to open flagship Cantina on Las Vegas Strip; Pizza Hut launches a chatbot ordering system; and Humana stock edges higher, breaking downward spiral”

A news summary, focused on 10 big employers; updated 5:30 p.m.

HUMANA‘s shares fell another 2.6%, or $4.15, to close at $154, as investors watched developments at the Louisville company and proposed acquirer Aetna, after executives mounted an 11th-hour battle Friday before antitrust officials to save the companies’ $37 billion merger. Aetna’s shares closed down 0.5%, or 56 cents, to $116.44. Last week, Humana tumbled 11% and Aetna a smaller 2% after news first leaked about the Department of Justice talks on Thursday (Google Finance). The company’s charitable foundation today announced a $225,000 grant to the Louisville Urban League to launch “It Starts with Me.” The insurer’s employees will visit the California, Parkland, Russell and Shawnee neighborhoods, helping families get health insurance, connect participants with support resources and find after-school activities for children (WLKY). Based in Louisville, Humana employs 12,500 employees in the city.

BROWN-FORMAN: A former North Carolina advertising executive was sentenced to 57 to 81 months in prison for defrauding two ad agencies in a scheme where he faked a series of contracts in 2012 with Brown-Forman and Coca-Cola Co. supposedly worth $269.9 million. The man, Bill Grizack, went so far as to create email addresses with domains closely resembling addresses of actual Brown-Forman employees, and used “burner” cellphones for made-up conversations with the whiskey giant (AdWeek).

Former Brown-Forman public relations chief Rick Bubenhofer has opened a boutique public relations agency, RBPR, with offices in Louisville and New York (TR Business).

In Nashville, the distiller’s Jack Daniel’s unit later this month is opening its first branded retail store outside its corporate home in Lynchburg, Tenn. Called the Nashville General Store, the outlet will sell clothing to barware and custom-made musical instrument displays. But it won’t sell whiskey because the store would need a liquor license (Tennessean via USA Today).

The Filson Historical Society is nearing completion of a $12 million expansion and renovation project partly underwritten with nearly $600,000 in contributions from Brown-Forman’s founding Brown family. The project includes a new, 20,000-square-foot Owsley Brown II History Center honoring the late Brown-Forman CEO. Founded in 1884, Filson is devoted to Kentucky and Ohio River Valley history and culture (Courier-Journal). Here’s a drone’s eye view of the project:

AMAZON Prime members now make up more than half the online retailer’s customer base, according to a new study. Consumer Intelligence Research Partners estimates Amazon counts 63 million Prime members among its shoppers — an increase of 19 million from last June (Fortune). Amazon stock traded at a new intraday high of $755.90 before giving back some; shares closed at $753.78, up $7.97, or 1%. Investors are anticipating tomorrow’s second annual Prime Day super sale; the stock closed at $. The retailer’s stock has soared 70% from a year ago vs. a much smaller 2.8% gain in the S&P 500 index. The company employs a total 6,000 workers at distribution centers in Jeffersonville and Shepherdsville.

TEXAS ROADHOUSE‘s stock also traded intraday at a new record 52-week high, $46.83, but closed at $46.54, up $1.12, or 2.5%.

A news summary, focused on 10 big employers; updated 3:28 p.m.

HUMANA and Aetna now face an uphill battle persuading antitrust enforcers their planned $37 billion deal won’t harm competition, after high-level talks between the Justice Department and company officials yesterday ended without public word of their outcome. It isn’t clear when the agency will make a final call. Company officials have been preparing for a decision as soon as this month, according to The Wall Street Journal, which cited people familiar with the matter that the newspaper didn’t identify. But officials also disclosed June 24 that they’d extended the deadline for completing the deal until the end of the year.

Humana’s stock has been reeling since news of the negotiations suddenly emerged mid-day Thursday; shares have fallen 11% since the day before. Aetna’s stock has fallen, too, but by a far smaller 2%, reflecting what investment bank JP Morgan said yesterday is the Louisville company’s greater downside risk if the deal collapses (chart, top).

JP Morgan downgraded Humana’s stock to “neutral” from “overweight,” after the probability of a deal approval declined well below a 50/50 chance, analyst Gary Taylor said. If the deal were not to happen, Humana’s shares could fall to a range of as low as $115 to $125. At $115, Humana would have sunk to the lowest level since May 6, 2014, when shares closed at $109.79.

That grim outlook isn’t universal. Wedbush Securities analyst Sarah James told CNBC: “We’re 80 to 90% confident that the Aetna deal is going to go through,” she said (CNBC).

The developments at Humana-Aetna and two other companies also planning a merger — Anthem and Cigna, for $48 billion — “are the latest signs that federal officials are worried about consolidation among health insurers,” the WSJ says. The deals “would reshape the top of the industry, collapsing five large insurers into three giant firms, each with annual revenues of more than $100 billion” (Wall Street Journal).

BROWN FORMAN: The U.S. State Department spent $21,733 to distribute 840 fifths of Jack Daniel’s as “gratuities” Continue reading “Humana-Aetna now in limbo after DOJ talks; Haier planning super fridge; Amazon rockets to 4th most-valuable company, and check your wallet for a $540 million jackpot”

Shares of big employers in the Boulevard Stock Portfolio, ranked by weekly performance at today’s closing price, with the S&P 500 index for comparison.