A news summary, focused on 10 big employers; updated 7:33 p.m.

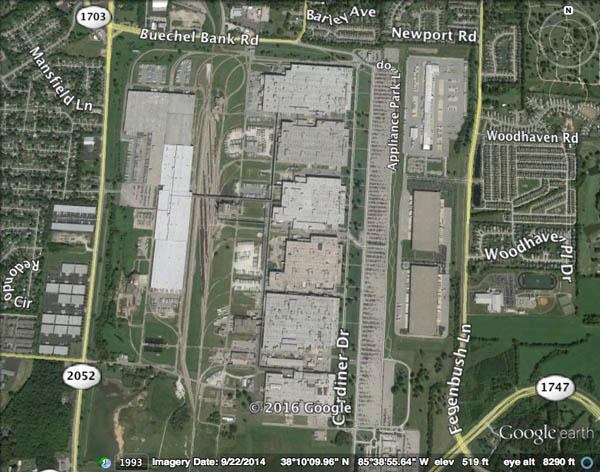

GE sold Appliance Park to Haier Group for five times what it claimed the complex was worth in 2013, when it won a dispute with Jefferson County over the southend property’s value, a dispute that ultimately reduced the taxes the conglomerate paid. At the time, GE said the complex was worth $23 million, nearly half the $42 million value assigned by Property Valuation Administrator Tony Landauer’s office (WDRB).

HUMANA beefed up security yesterday after reports of what some employees said was a threatening graffiti message written on a bathroom wall at the insurer’s Waterside building downtown, one the company seriously enough to allow employees to go home early. The FBI is investigating the incident, said WAVE. The threat may be related to annual gay pride events planned downtown this weekend. Several employees told WLKY the graffiti referenced last weekend’s mass shooting at an Orlando gay bar, where a suspected terrorist possibly inspired by ISIS killed 50 people and injured another 50 (WAVE, WLKY and Courier-Journal).

Yesterday’s incident came after authorities arrested a Jeffersonville man arrested in California who was heavily armed and headed to a gay pride event, plus reports of possible copycat threats at a New York gay bar and in the U.K. June is gay pride month in many cities, with parades and other public festivities (Courier-Journal, Time and BBC).

BROWN-FORMAN filed its annual 10-K report with the Securities and Exchange Commission this morning; as always, a key section describes the business itself. The filing came a day after the whiskey giant disclosed how much it paid CEO Paul Varga and other top executives, plus fresh details about the value of the controlling Brown family’s $6 billion in stock holdings (SEC document).

PIZZA HUT‘S bacon-stuffed pizza has arrived in the U.K., but only for in-the-know customers. “To savour one of the new pimped-up crusts, all you need to do is whisper the secret words ‘Bacon Crust Have’ when ordering any large pizza (Mirror). Also, the chain has brought back its Triple Treat Box in a special summer edition, “a tri-level wonder decorated to look just like your favorite picnic basket” (Delish). It includes two medium one-topping pizzas, bread sticks and the just-introduced Ultimate Hershey’s Chocolate Chip Cookie (Brand Eating).

PAPA JOHN’S: In San Diego, no injuries were reported after an SUV crashed into a Papa John’s Pizza restaurant yesterday afternoon (KGTV).

TEXAS ROADHOUSE is looking for Baltimore area cooks “who are ready for a fun and rewarding career in the restaurant business.” Applicants are considered without regard to race, religion, color, age, gender, disability, veteran status, sexual orientation, citizenship, national origin, or any other legally protected status (Craigslist). Apparently, gender expression hasn’t made that list — yet.

UPS: In northern California, a UPS driver who happened to be on the scene rescued a crazy-cute puppy dumped Tuesday evening in the street by a passing vehicle. The Modesto Bee identified the driver as 39-year-old Jason Harcrow of Hughson. Police said the puppy, believed to be a Cairn terrier less than a year old, was in great spirits and would be put up for adoption at the county shelter (KPIX). The driver who abandoned the pup is expected to spend eternity in hell with tobacco lobbyists.

In other news, U.S. stocks closed slightly higher, with the Dow Jones Industrial Average and other indices up less than 1% (Google Finance). Among Boulevard’s 10 big Louisville employers, Papa John’s performed best, closing at $65.89, up 2%. And on the A-list front, there was no news of any consequence about Louisville native and Oscar winner Jennifer Lawrence.