A news summary, focused on big employers; updated 7:40 p.m.

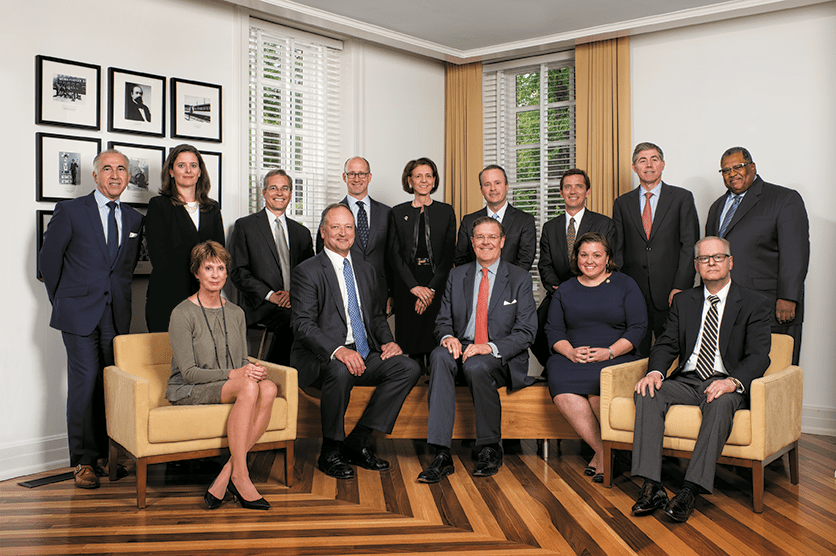

BROWN-FORMAN shifted its 13-member board of directors, electing Campbell Brown, Marshall Farrer, and Laura Frazier, effective today. The company also announced a regular quarterly dividend, and a special two-for-one stock split for both voting Class A and non-voting Class B shares. The split shares are expected to be issued to stockholders of record around Aug. 8, and distributed about Aug. 18 (press release). This is the 12th split since shares were first listed in 1933 after Prohibition’s repeal; the most recent was a three-for-two in July 2012. (Dividend history.)

The three new directors are all fifth-generation descendants of George Garvin Brown, who founded the distiller in 1870. “This election continues a multi-year evolution of Brown family representation on the board,” the company said. “As part of this process, Martin S. Brown Jr., Sandra Frazier, and management director James Welch Jr. — who’s retiring as vice chairman on Tuesday — have elected not to stand for re-election at the annual stockholders’ meeting in July” (press release also includes bios of new directors). Brown-Forman said the directors’ decision to exit the board wasn’t due to a disagreement with the company (SEC filing).

The company didn’t disclose the new directors’ ages; those retiring are in their 40s and 50s. (Executive and board profiles.) Today’s moves were not unexpected; the Brown descendants effectively control the company through their ownership of more than 50% of the Class A voting stock, and have historically voted as a bloc (2015 proxy report). Of particular note, Laura Frazier is owner, chairman, and past-CEO of Bittners, the more than 160-year-old high-end interior design firm on East Main Street in NuLu. At the end of trading today, Class A shares closed at $104.21, down 25 cents.

KINDRED just filed a raft of documents disclosing stock awards to members of the board of directors (SEC filings; look for all Forms 4 on today’s date). Also, the hospital and nursing home giant disclosed the breakdown of yesterday’s shareholder vote tallies at the annual company meeting; no surprises (SEC filing). Yesterday, Kindred had only reported that stockholders approved the executive compensation plan, and re-elected the full slate of 11 directors to the governing board — but without providing details.

KFC Canada says a much-loved, one-of-only-two-left, all-you-can-eat buffet-style restaurant in Weyburn, Saskatchewan, won’t be shut down after all — yet, anyway. Residents had taken to social media this week when rumors circulated the buffet was a goner. A sit-in was planned for yesterday. Even high government officials got involved: Saskatchewan Premier Brad Wall took to Twitter (see below) on Tuesday, asking Yum to reconsider. The Weyburn KFC buffet was the first to open among the Canadian franchises in 1988; there’s now just one other left, in Saskatchewan’s Humbodlt (Global News).

Elsewhere in KFC land, actress Ann Hathaway jokingly compared comedian James Corden to a 16-piece you-know-what during a rap battle on The Late Late Show last night. “You look like a KFC bucket with a lot of extra breasts,” she said (Express).

UPS and its 2,500-member Independent Pilots Association union are making progress on bargaining a new contract (Courier-Journal). The pilots have been working under the terms of their previous contract for five years, and the union late last month set up a strike center here in Louisville.

GE: Qingdao Haier Co. has launched India’s first 44-lb. capacity washing machine. The Chinese company’s pending $5.4 billion purchase of Appliance Park is expected to close this summer (Newkerala and Courier-Journal).

In other news, the University of Louisville Foundation paid President James Ramsey $2.8 million in 2014, according to its newly disclosed IRS tax return (WDRB). The return “appears to belie Ramsey’s claim last year that his compensation in 2013 was an anomaly” (Courier-Journal). The disclosure came one day after a published report that the foundation lagged many other Kentucky school foundations in annual investment performance.

Finally, Louisville Magazine has released the finalists in its annual Best of Louisville awards for businesses and individuals (Louisville).

BROWN-FORMAN is reportedly considering a sale of Finlandia vodka amid a broader effort to focus on its whiskey business; the company spent $200 million to assemble the vodka business from 2000 to 2004. Brown-Forman declined to comment on the report (

BROWN-FORMAN is reportedly considering a sale of Finlandia vodka amid a broader effort to focus on its whiskey business; the company spent $200 million to assemble the vodka business from 2000 to 2004. Brown-Forman declined to comment on the report (