Latest business news focused on big Louisville employers.

FORD CEO Mark Fields yesterday nixed the idea of a merger with Fiat Chrysler, initially proposed by Fiat chief Sergio Marchionne, who said Ford could be a potential merger candidate. Marchionne has long called for mergers among large automakers to help cut development costs for advanced cars that pollute less (Reuters). Also, Ford has received more than 7,000 applications to buy its new 2017 GT supercar – with just 500 planned for production. The GT is expected to sell for more than $400,000. It’s been more than a decade since Ford last launched such a pricey vehicle (Torque News).

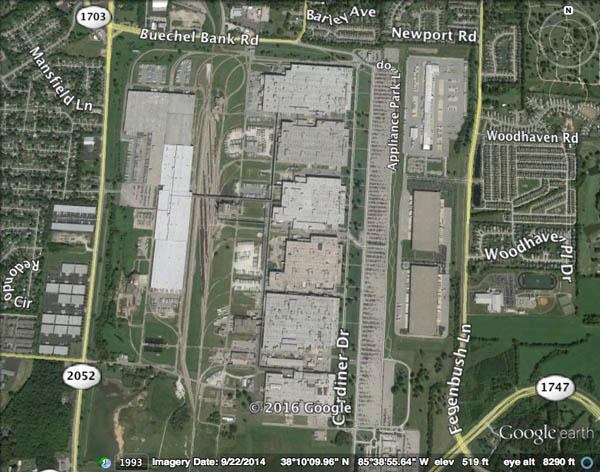

GE’s appliance division starts readying employees for the transition to China’s Haier Group next week, according to an employee letter from GE Appliances CEO Chip Blankenship, dated Friday. The $5.4 billion sale is to close around June (WDRB). Also Friday, GE reported lower first-quarter underlying revenue, citing weak sales of oil and gas drilling equipment (Reuters). The press release.

YUM‘s second-quarter profit rose as its China business continued to show signs of recovery, posting its third consecutive quarterly increase in a key sales metric. The results handily beat forecasts on the bottom line, but missed on the top. Excluding special items, Yum reported earnings per share of 95 cents vs. 80 cents a year ago. Revenue was $2.62 billion. Analysts surveyed by Thomson Reuters had projected 83 cents a share on $2.65 billion in revenue (

YUM‘s second-quarter profit rose as its China business continued to show signs of recovery, posting its third consecutive quarterly increase in a key sales metric. The results handily beat forecasts on the bottom line, but missed on the top. Excluding special items, Yum reported earnings per share of 95 cents vs. 80 cents a year ago. Revenue was $2.62 billion. Analysts surveyed by Thomson Reuters had projected 83 cents a share on $2.65 billion in revenue (