A news summary focused on 10 big employers; updated 1:01 p.m.

YUM: Two activist groups filed a shareholder proposal today requesting that fast-food giant Yum quickly phase out harmful antibiotic use in its meat supply, taking particular aim at the KFC unit’s nearly 15,000 restaurants, according to Reuters. The request from the Sisters of St. Francis of Philadelphia and As You Sow of Oakland, Calif., say KFC lags rivals McDonald’s, Chick-fil-A, Subway and Wendy’s in setting policies to curb routine use of antibiotics in chicken production.

In a statement issued after reports of the shareholder proposal, KFC said its “position on antibiotics is currently being reviewed to determine the viability for our suppliers to go beyond the FDA guidelines for antibiotic usage,” according to The Courier-Journal.

Yum’s 6,500-Taco Bell chain has agreed to stop using antibiotics for humans in its chicken supply early next year. The 14,000-unit Pizza Hut division has made a similar promise for pizza topping chicken. But KFC, which buys far more chicken than the other two brands, hasn’t budged (Reuters and Courier-Journal). Buy a boxing nun hand puppet at eBay for just $35.99 (auction listing).

BROWN-FORMAN named Marc Satterthwaite as new managing director for Australia, New Zealand and Pacific Islands, taking over from Michael McShane, who’s retiring Oct. 31 after 17 years with the company. Satterthwaite has held several leadership positions, including division director for the U.S. central states and Canada, director of North America Region sales operations, and as the interim country manager for India. Most recently, he’s been chief of staff to the U.S. commercial director (The Shout).

TEXAS ROADHOUSE competitor Logan’s Roadhouse — founded in Lexington in 1991 — has filed for Chapter 11 bankruptcy protection in Delaware. The Nashville-based steakhouse chain said Monday in its petition that it will close 18 under-performing restaurants; it has 250 overall. Logan’s was easily confused with Louisville-based Texas Roadhouse because of their similar formats, including encouraging patrons eat buckets of free peanuts and drop the shells on the floor (Lexington Herald-Leader). Texas Roadhouse shares recently traded for $45.48, up 1.3%, or 59 cents.

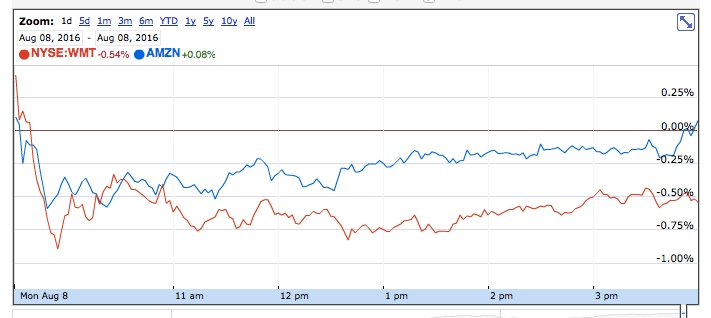

AMAZON founder and CEO Jeff Bezos sold one million of his company shares last week, raising $757 million, according to a Securities and Exchange Commission filing. That’s a record for Bezos, exceeding the $671 million he sold in May (Fortune). Amazon’s stock closed yesterday at $766.56, near its all-time high of $770.50 (Google Finance). Say yes to this dress: The retailer’s best-selling wedding gown is gorgeous and a bargain to boot: as little as $16, a steal when the average bridal dress costs $1,357 (Refinery 29). Amazon employs 6,000 workers at distribution centers in Jeffersonville and Shephardsville; more about its local operations.

GE: Twisting the knife in the back of all the cities that didn’t land GE’s new headquarters, the conglomerate has unveiled renderings of its planned, new, high-tech 2.4-acre corporate campus in Boston. The design shows a 12-story building with a giant, sail-like veil and GE logo on top. The former owner of GE Appliances is moving from Fairfield, Conn., its corporate home since 1974 (Boston Globe and Seattle Times).

GE sold GE Appliances to Haier for $5.6 billion in June. The maker of refrigerators, dish washers and other “white goods” employs 6,000 workers in Louisville’s Appliance Park.

Earlier today, news emerged that Amazon’s office has been searched by Japan’s Fair Trade Commission over its dealings with merchants who sell goods through the retailer, a person with knowledge of the matter told Bloomberg. The antitrust agency is looking into whether Amazon sought deals with sellers that gave it more favorable conditions over other e-commerce companies in one of its biggest foreign markets. It wasn’t immediately clear when the JFTC inquiry took place (

Earlier today, news emerged that Amazon’s office has been searched by Japan’s Fair Trade Commission over its dealings with merchants who sell goods through the retailer, a person with knowledge of the matter told Bloomberg. The antitrust agency is looking into whether Amazon sought deals with sellers that gave it more favorable conditions over other e-commerce companies in one of its biggest foreign markets. It wasn’t immediately clear when the JFTC inquiry took place ( “Bottom line,”

“Bottom line,”

TACO BELL is introducing its latest mash-up experiment, the Cheetos Burrito, mid-August in Cincinnati for $1. This is the second version sold by the Yum unit; it rolled one out last spring, the

TACO BELL is introducing its latest mash-up experiment, the Cheetos Burrito, mid-August in Cincinnati for $1. This is the second version sold by the Yum unit; it rolled one out last spring, the