Here’s how we’re getting more and more inured to terrorism: The stock markets now barely flutter after rampages like what happened last night in Nice.

Category: Investing

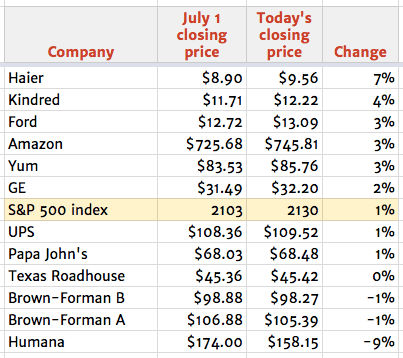

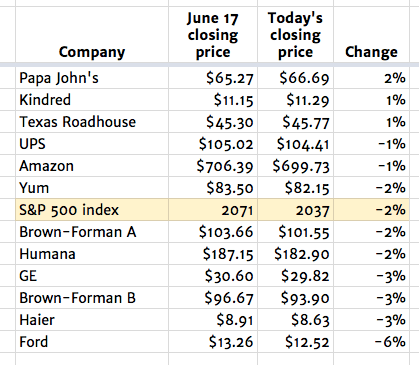

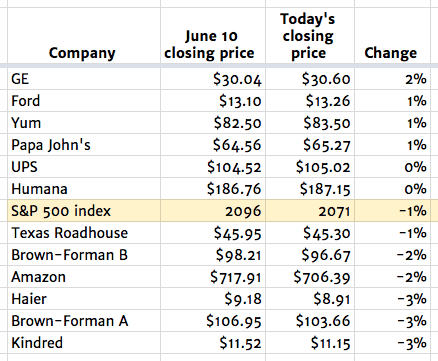

Shares of big employers in the Boulevard Stock Portfolio, ranked by weekly performance at today’s closing price, with the S&P 500 index for comparison.

Shares of 10 big employers in the Boulevard Stock Portfolio, ranked by weekly performance at today’s closing price, with the S&P 500 index for comparison.

Shares of 10 big employers in the Boulevard Stock Portfolio, ranked by weekly performance at today’s closing price, with the S&P 500 index for comparison.

Discretion is everything in the wealth management world. That’s why the court challenge around the Glenview Trust Co.‘s launch 15 years ago grabbed such unwelcome headlines — before it got settled, of course, for $525,000. That controversial start apparently didn’t dent eventual success at the firm, which is akin to a large family office. Its motto: “enriching life.”

Today, Glenview — named for the posh community where the company is located east of Louisville — says it’s the commonwealth’s biggest independent trust company, working exclusively for individual investors. Glenview now represents more than 500 wealthy families, with a combined $6.5 billion in assets.

Its pitch: “Glenview Trust is a local, closely-held company with employee ownership, our professionals act and think differently. We are not accountable to a headquarters in a distant city, which allows us to effectively and efficiently accommodate our clients’ unique situations.”

Glenview has 40 employees, including nine attorneys. How much does it earn servicing those 500-plus families? That’s hard to estimate without knowing the firm’s fee schedule. Industrywide, fees vary widely, often stair-stepping down as account values rise. But applying a relatively low 0.5%, that would generate $33 million a year.

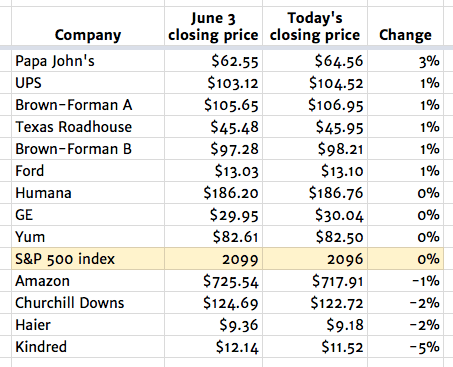

Here are shares of big employers in the Boulevard Stock Portfolio, ranked by weekly performance at today’s closing price, with the S&P 500 index for comparison. Starting this week, we’re adding a new one to the portfolio: Qingdao Haier Co., which we’ll be referring to simply as Haier; its shares are listed on the Shanghai exchange.

Here are shares of big employers in the Boulevard Stock Portfolio, ranked by weekly performance at today’s closing price, with the S&P 500 index for comparison. Starting this week, we’re adding a new one to the portfolio: Qingdao Haier Co., which we’ll be referring to simply as Haier; its shares are listed on the Shanghai exchange.

The Chinese company completed its $5.6 billion purchase of 6,000-employee Appliance Park on Monday, along with the rest of GE’s “white goods” business, making refrigerators and other residential appliances. Boulevard will continue to track GE’s stock, too, given all the shareholders in Louisville.

Haier (pronounced “hire”) didn’t have the best debut here; shares fell 2% from a week ago, to $9.18.